11 Apr 2021

i think when finally deciding to start your journey into property investing the first other question to ask yourself is will you be buying a property in order for you to stay in or a property for you to rent out aka for investment purposes. But this depends on if this will be your first property or not. To be honest, im a very strong proponent of buying to rent out, even if it’s your very first property. i mean, rent where you are staying while/and buy a property to rent out. Ok, hear me out, then you decide…

So, i am going to use an example as per my property investment strategy. Please note, a strategy is very important, you need to think out a strategy and focus on it. It also helps to keep you on track. My current strategy is to purchase mainly 1 bedroom apartments of MV (Market Value) say about R 450k. WHY? Well first, i cannot afford 2 bedroom apartments or townhouses of about 700k-800k. So, let me rather start with the 1 bedroom apartments …

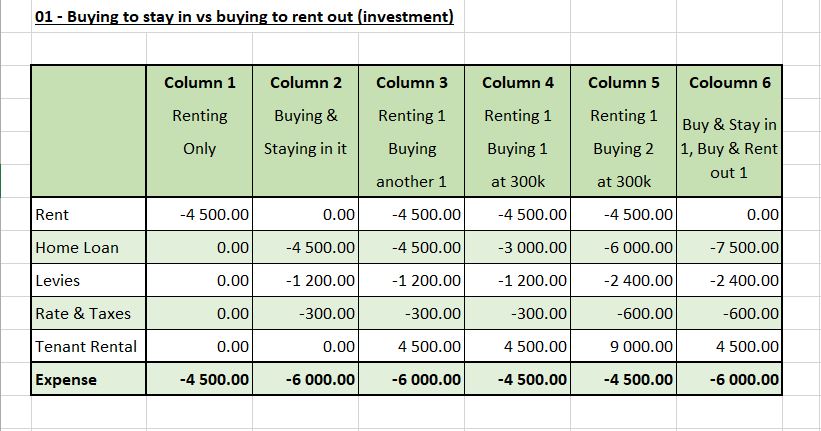

Look, there is definitely plenty of assumptions on my take below, and these are necessary for the story/plan. i have also made the decision to say or keep the interest rate at 10%, which was averagely the pre lockdown level as eventually the interest rates will be returned to those levels. Ok, here goes… oh, i recommend that you look at the spreadsheet will reading the explanation below… ps, just a tip!

Column 1:

Let’s take your average 1 bedroom flat 1 apartment with a MV of 450k. Typical rental will be 4500 per month (1% of MV).

Column 2:

However if you are buying the apartment, it will cost you R4500 on home loan repayment plus R1200 levies plus R300 for rates and taxes, total = R6000. Assuming 10% interest…

Column 3:

Here you are renting an apartment but also buying an investment flat/apartment of MV R450k and you renting it out for 1% of MV which is R4500.

Column 4:

What if you manage to purchase a flat/apartment of MV 450k at but for R300k and still rent it out at 1% of MV at R4500. All the while you still renting at the 450k MV apartment.

Column 5:

How about you still renting where you are currently residing but you however able to purchase two investment flats/apartments of MV R450k but at R300k?

Column 6:

And just to add another option/dimension. Let’s say you buy 1 apartment at MV R450k and stay in it and also buy another apartment for investment of MV 450k but at R300k and rent it out.

i think by now you can see the pattern, expenses and different options or scenarios. Feel free to play around and twist and turn to try see a scenario you would maybe interested in. But the big question is surely sticking out like a sore thumb. Where will you be able to find a property of MV R450k and be able to maybe purchase it for between R300k-350k? Wouldn’t that be super NICE!! But also don’t ever forget the different variables involved in property investing. These will include but not limited to interest rates, occupancy rates, maintenance, tenants and all the hustles of owning, renting and renting out property.

An added advantage of renting where you are staying is that if you don’t really like where you are staying what do you do? You could simply cancel your lease or wait for it to expire and then look for another place which you think you would like or enjoy. But if its your purchased place, then that definitely changes the dynamics.

Lol, so have i managed to arouse your curiosity? Have i awakened a sleeping beast? i think my aim is mainly just to give you a take on a different perspective that then encourages or rather let me be forceful here, but rather demands that you have a second look and wanna investigate and learn more about different options and strategies out there. Will it work for you? Is that what you might be interested in? And if i have managed to arouse a little something in you … then i think my aim is just beginning … Ciao!!