When finally deciding to buy property or build your property portfolio, one of the things you should try decide very early on is the capacity in which you would like to buy your properties. The easiest and the most normally / commonly used is personal capacity, that is buying property in your personal name meaning that it would be registered in your personal name. There is other options, namely buying in a company and/or a trust.

There is many pros and cons of personal name vs company vs trust capacity, but im here to try point you towards the direction of a company. i think it’s safe to say one of the reasons of property investment is wealth and legacy creation. Legacy creation meaning you would want your portfolio to keep providing for your beneficiaries after you have passed on. For me, currently a company is my vehicle / capacity of choice. Initially like any other person, when i bought my first property it was in my personal capacity. However as i later wanted to start building a portfolio, i then realised that a company was the next best choice. With regards to Trusts as a vehicle capacity, i still have to learn and understand them more. They are a bit more complicated than a company, but i hear they provide more asset protection of your portfolio.

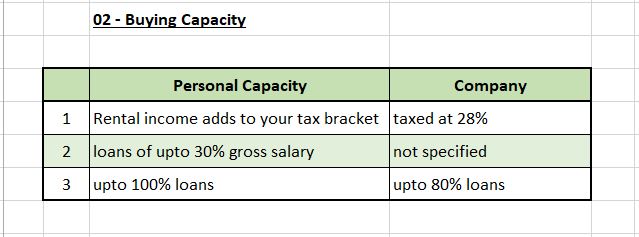

Well, go ahead and do your own research on the vehicle you would like to use or is more suited to what you would like to accomplish. Below is my simple, and small basic personal vs company comparison:

Also note that banks currently grant you home loans of up to 30% of your gross salary in repayment amount. Once you go over the 30%, they say you oversubscribed and this can definitely limit the pace of which to grow your portfolio.

A [Tricks & Tips] i have heard about purchasing via a company is that any property bought by your company however using your salary capacity does not fall under the 30% gross salary plan as it will be registered in the company name. Remember though that a company does require compliance and accounting documents. However this is a good thing and a way of making sure that your property portfolio is operating and run as the business that you wanna grow it into.