Sometime before lock down i had a brief Starbucks sit down with twitter persona @FrugalLocal. He has property experience, financial intelligence and good ideas but the best part is he shares his experience, knowledge, tips and tricks freely and readily. So during the sit down, he asked me which i prefer 20 year home loan or 30 year home loan.

i told him my thoughts at that time. i prefer a 20 year loan because i cannot imagine paying for 30 years, that’s a very long period. Even though my current strategy is never to quickly finish paying off a home loan i still preferred the 20 year period. He then proceeded to ask me in a very calm manner that if the property for the home loan has a positive cash flow then why would i want to give the Bank their money back quickly and thereby decreasing your (my) cash flow amount? You know, sometimes you get moments whereby you took up but are actually looking back at yourself introspectively and asking yourself but why? That was that moment for me. i had never thought of it that way.

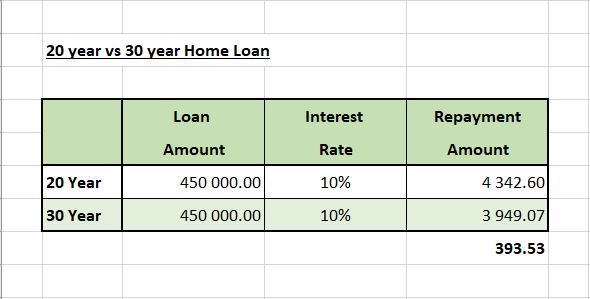

So let me try break it down a bit with the help of the spreadsheet below:

Lets take an example of a 450k home loan. Remember this is other people’s money (OPM) lol a buzz ward in property investing lingo. And if the property has a positive cash flow, this means you are using other people’s money to make yourself some money… cash flow. So the question is why reduce your cash flow and give back the money that is enabling you to make money? So in the table above, there is a difference of about R400.00 per month that you could be adding to your cash flow while buying a property, with money that is not yours and making money from it (positive cash flow). Then why would you want to rush and pay back the loan in less time? To decrease the interest you paying back to the bank? But who is paying the interest, is it not your tenant? Hmmmm some food for thought.

This also will have to align with your property investing strategy. Plus please make sure to never forget the risks and implications involved in property. That will include tenant occupancy rate, interest rates, maintenance and others. You might ask but what if i pass away before concluding the home loan. The answer is simply – this is where your life insurances and policies come into play. Also remember to put in to play your wealth and legacy creation and protection strategies in place.

Following my sit down with @FrugalLocal i have then re-adjusted my strategy. i now actively prefer 30 year home loans and will continue to try use and leverage them in order to slowly grow my portfolio.

Another take away from this is the importance of sit downs aka coffee meetups aka networking and hearing and sharing different ideas and experiences. Thanks @FrugalLocal!