On the 24th of February 2019 while having breakfast at the Mall of the North, Polokwane, i received an SMS from Absa, my bank informing me of suspicious transactions on my Absa credit card and that i should call the card division immediately. And immediately, i did call. After being verified that im the rightful owner of the credit card, i was asked if i was the one using Bolt(Taxify) as there were Bolt(Taxify) billings on my card since the day before. I proceeded to inform the consultant that no, i was not using the Bolt(Taxify) service or even registered for it and also that i was currently on my way from Limpopo to Gauteng and had been in Limpopo for the past 2 days. The consultant then proceeded to tell me that i should either temporary block my card using the banking mobile app until the transaction can be verified OR cancel the card and order a new replacement card. Now both these transactions can be done on the mobile app! I decided on cancelling the card altogether and ordering a new one because i figured that my card was already compromised and a temporary lock will not be a good idea because once it’s unlocked, more fraudulent transactions may once again be re-directed to my card.

I proceeded to cancel my card via the mobile app and continued on my journey back to Gauteng. Now i had to start using my debit card for my transactions (payments, purchases and toll fees). This was one of the drawbacks i experienced after cancelling my credit card, well besides the fraudulent transactions. Thing is, i use my credit card for ALL my transactions (purchases). Why? Well, the transactions are free PLUS i get Absa Rewards for using my credit card PLUS it helps me keep track of my expenses – one of my [TIPS & TRICKS].

Now, maybe you are wondering how come i did not receive SMS notifications of the fraudulent Bolt(Taxify) transactions and only reacted after receiving an SMS from Absa notifying me to call their card division? Well, eish … i actually deactivated my SMS notifications for all my credit card transactions. Then, i had a strong case for this BUT in hindsight, i think it actually was not a good idea, strong case or not. I also do not what to disclose what this strong case was. However, i am very impressed with the systems at Absa. The systems noticed that i was busy swiping away in Limpopo but at the same time also travelling around in Gauteng. The systems noticed that something was definitely not right and hence notified me of these suspicious transactions. Thank you Neo (lol- the Matrix). I have of now re-activated SMS notifications for my credit card transactions.

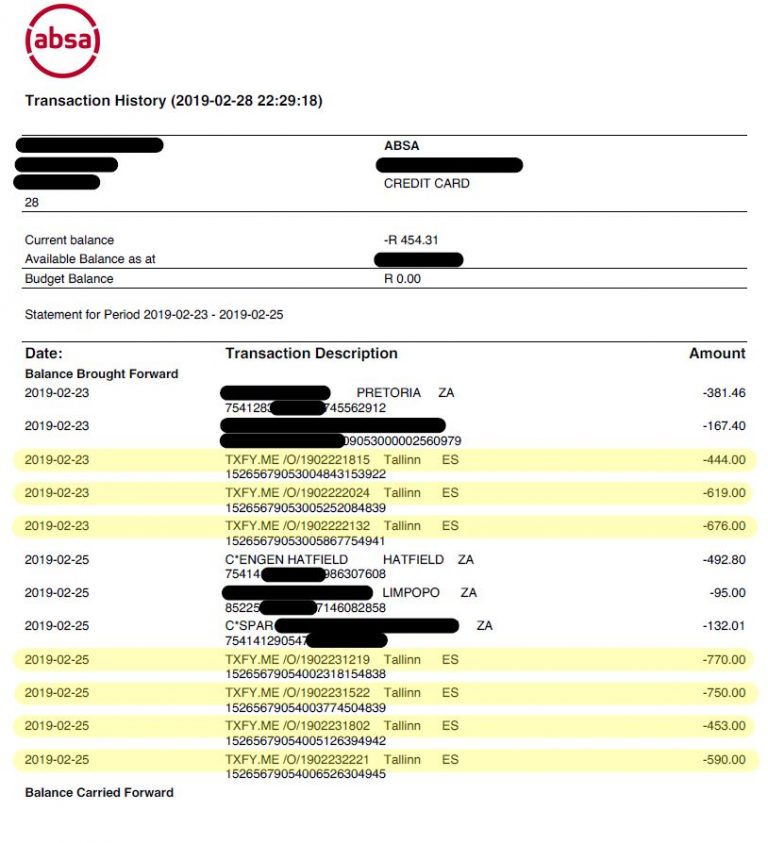

The next day, i called Absa Card Fraud Division and lodged a case. I was given a case number and emailed a card fraud declaration form which i had to fill in and sign and return, which i did. I also attached a printout of the fraudulent transactions with amounted to 7 transactions totaling R4302.00. (as in image above). I was informed that the process takes up to 30 days for investigations and will get Absa’s response then. What? 30 days? Eish, but i guess that’s their process and there was nothing i could do but wait. Oh, and there was no need for me to go and open a police case – it was and is not required at all! Eish imagine having to go to the Police Station, eish that’s another mission on its own.

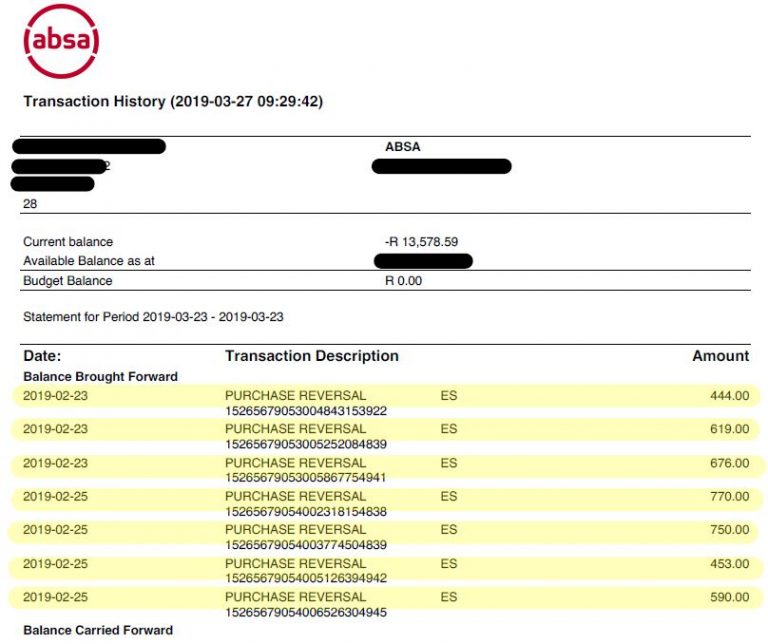

BUT wait, what about Bolt(Taxify)? Why are they billing me while i have never even used Bolt(Taxify) and never have registered on their app. I have only ever used Uber. So i went on HelloPeter.com and noticed that Bolt(Taxify) encouraged people to lodge complaints via email. I then sent a complaint to Bolt(Taxify) via email. Then i had a light bulb moment – how about Twitter? Twitter and other social media are now being used to escalate and get complaints quickly attended to. Yep, so i tweeted my complaint to Bolt(Taxify) and wala, within a few minutes i was being attended to. Also my email complaint was responded to and i was informed that they have also noticed my Twitter communication and that i should continue with the twitter communication instead of the email as it was quicker. Wow – now that’s what i call synchronised support. Bolt(Taxify) requested that i provide them with my contact number that is linked to my account but i informed them that im not a customer and have never used Bolt(Taxify) and that i was not even registered for Bolt(Taxify). I then sent Bolt(Taxify) my credit card statement showing the 7 Bolt(Taxify) fraudulent transactions. Then, in order to verify that they were communicating with the rightful owner, Bolt(Taxify) requested that i send them a picture of myself holding my ID document, a selfie with my ID! Lol! What? They promised that the picture will immediately be deleted from their servers once i had been verified. Oho, like i believe them! Okay, so i took the selfie BUT i blacked out the remaining digits of my ID and left only the digits of my date of birth. And thus i was verified – yeah! In all this communication, i repeatedly tried to get a case number or ref number for my case, but tjo my request fell on deaf ears and i was tactfully ignored. Looks like they don’t operate with ref numbers – well, what else can i say? The next day, i was informed that i had been refunded for the fraudulent transactions BUT they will only reflect within 15 days – well thank you, couldn’t wait …

But, where will it be refunded to since i cancelled my credit card? I received a notification that my new credit card was ready for collection (11 Mar 2019) – i always choose to collect and not to get it delivered. I believe there is an extra charge for delivery vs collection. I used this opportunity to ask what happens to my old credit card account? Turns out that the credit card account does NOT change, only the credit card number changes. Ha? So, the credit card account is an internal bank account and the credit card is linked to that account. So only the credit card number changes not the account. Wow – okay – another short lesson learnt.

SMS Received on 23 March 2019 from Absa: Your fraud case has been refunded with R4302.00 on 23/03/2019. We apologise for the inconvenience. Your patience is appreciated. Well, just in time, and within the 30 day period.

Well again, thank you. Case closed!! Old compromised credit card cancelled. New card collected. Fraudulent amounts refunded. Any lessons to take away? Yes, definitely and plenty or rather quiet a few.

- Fraud can happen to anyone / anywhere / anytime

- Be sure to activate SMS notifications – it’s an early warning system

- Cancel any compromised cards

- Lodge cases with respective offices – multiple if you have to

- Social media is also an important helpful tool

- Don’t be afraid to also use mobile apps – can be and is a quick and convenient way to use services.

So where and when was my credit card compromised? I have honesty tried to look back at times when i used my credit card and there was any incident or hint of any issue but no, nothing weird or nothing odd that happened comes my to mind …