How to get access to more funds by refinancing your home loan.

We have often been told or informed about leveraging your property in order to get access to cash right? Well, i think home loan refinancing is maybe an aspect of leveraging … right?

The story is i over used my credit card. Ok, let me be a bit honest, i actually used the credit card that i should not actually use. So, i have 2 credit cards, 1 for everyday use and the other for when i need access to funds.

So i used the second one and i did not have money to repay the money used or rather i did not have money to return to the credit card. It is then i decided to refinance the home loan of my rental apartment in order to repay my credit card.

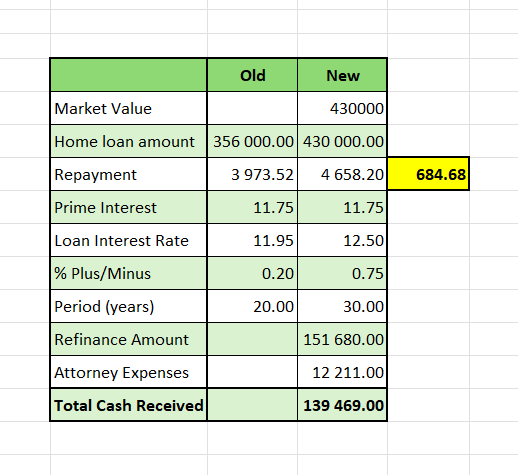

i called the bank, Absa and i informed them i would like to refinance my bond and they sent me the application forms to fill in which i did. The application forms is the basic home loan application form that also requires that you fill in your full personal income. In a few days, i received a quotation based on their evaluation and they asked if i accepted the quote. i accepted the quote and below is the values.

Lessons:

1: in hindsight, i feel i could have bargained more and requested that my interest rate remain the same instead of the slight increase- but i was in a bit of a hurry for the funds and i did not want to cause a delays with too many back and forth.

2: with regards to the market value of the apartment, there was nothing i could do as the latest sells in the block where averaging R430k. A year ago the market value was around R450k – R500k and the decrease in value was eish, in fact caused by me and my buddy but that is a story for another day and on a different story link.

In the end, R139k was paid into my home loan access bond account and i transferred R100k to the credit card which i had withdrawn funds from.

My thinking was and is that the interest rate of a home loan is way less than that of the credit card. So it would be better to use the home loan monies to pay the credit. As it has also been said that if you pay the minimum amount required by a credit card, it can take up to 5 years to pay off the credit card, depending on the monies owed.

i will be honest, i have not done the calculations. Also it must be noted that by re-financing, you also get to increase the home loan period back to 20 years or 30 years depending on your choice. But for me, that is not an issue yet as one of my property strategies is not to finish and close a home loan account but continue using it to have access funds in it.

At the end of the day, i got access to the desperately needed funds and im paying R 684.68 for that privilege. However, any extra funds i make, i will put back into the home loan for access later, whenever i need it.

Could this be something you might be interested in? But, you would have to look at the pros & cons for your situation and requirements and then decide for yourself if this would help you out. For me, it did and i hope you do you own maths before deciding … All the best …