This story begins when our property stokvel was now ready to start or try purchase its first property. But this article is not about the stokvel but about the property deal that went slow, then ultimately died away.

So we did the normal property sourcing via Property 24. We were still at the beginning of our property knowledge journey, so sourcing meant looking on Property 24 and Private Property. We did the normal viewings and cashflow analysis of the different properties. Our target or strategy was a simple 1 bedroom apartment but also of levies below R1500. i personally think that levies of over R1500 in flats is a no go. Also i think that higher levies sometimes tend to be compensating for others who are probably not paying their levies. Levies aside, we found a potential 1 bedroom apartment in Arcadia on Stanza Bopape Street at Elatus.

Now during our varsity days, we once had a colleague who stayed in that block of flats and we would occasionally have a few drinking sessions there. So it was an easy decision to decide to buy that apartment. lol and ladies and gentlemen, that’s how we broke the first law of property investing – do not be emotionally attached to a property. And furthermore, the Property Agent was black so we also felt like we were doing our empowering part as well.

Our shareholder’s meeting agreed to purchasing this particular apartment. It was priced at R400k but we put in an offer of R390k and it was accepted by the owner. We paid the deposit of R74,6k as 20% deposit to the attorneys was required as we were purchasing via a company, our stokvel. Then it was the normal waiting process. So usually, a property transfer on average can take about 3 months. It can be quicker or it can be slower, but just budget for the average 3 months period. Also i think it is standard procedure that the attorneys will give weekly progress updates with regards to the transaction.

But our transaction was not moving. i called the Estate Agent only to be told that the owner was in arrears of about R40k and that needed to be paid before the transaction can be processed. The Agent proceeded to assure us that the owner will be paying it as soon as possible. But what the hell?? Why had we not been informed of this before? Would this have a a deal breaker … definitely. And to this day, i still don’t know what arrears the owner had. Was it levies or the home loan or rates and taxes at the municipality? i didn’t ask. We even asked the attorneys to use the deposit we had paid for the arrears, but the attorneys said it was not possible.

Okay, we had no option but to wait for the owner to arrange for the funds. However, a month went by and still no payment from the owner. We then realised that the owner was unable to raise the funds and that this was going to delay our first inroad into the property market. We contacted the attorneys and informed them that we could no longer wait and we would like to cancel our Offer to Purchase (OTP) as the owner could not sell us the property because of the debt he had. The attorneys mentioned that the Law requires us to give the seller 20 business days to come up with the funds and sort out the problem. They also mentioned that we (the buyer) would still be liable for some of the services that the attorneys had provided during this transaction.

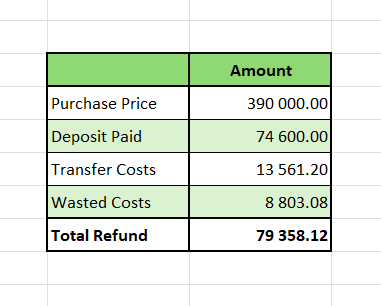

We had already decided to cut our loses and move on. So i instructed the attorneys to go ahead and give the seller the letter of demand with 20 business days to come up with the funds in order for the transaction to continue. After the 20 days passed, unfortunately the law also requires a further 7 days notice which was given to the seller and again he would not raise the amounts. So finally we were able to cancel the Offer to Purchase (OTP) we then received back our deposit from the attorney’s minus the costs of the services already provided by the attorneys which amounted to R8 803.08.

In hindsight, and i have mentioned this in another article, i think we should have billed the costs of the attorney’s services (wasted costs) instead to the sale Agent as she had not disclosed this information. Another recourse maybe we could have reported her to the previously EAAB , now PPRA as it is one of the duties of a Property Practitioner (Estate Agent) to disclose any and all information that may affect any transaction. Would that have helped though … i doubt anywhere.

Also going forward, the Government has of late put into Law a provision for the owner/seller to disclose anything in respect to any land or property that is being sold. If the purchaser discovers any defects which were not disclosed during sell, then the seller/owner will be liable for those expenses and also it may be grounds for breach of contract. This is a very powerful provision as many buyers have bought property with defects and only to discover those defects after purchase and only for the owner to deny knowing about them.

i have also seen how useful this disclosure section is with regards to Rental Mandates from owners. Even though you do an inspection when signing up the property, you still give the owner the opportunity to list any issues that they are aware of with regards to the property. This also helps mitigate any discoveries by a new tenant. i have experienced this, whereby an owner did not disclose a critical situation about their apartment which we were managing and renting out and when the tenant reported it, the owner was aware of the situation. Then in the mandate, there was no disclosure section. Will that still be grounds termination of mandate? Is that the kind of service you would want to provide to your tenants? i think it would depend on the severity of the not disclosed condition.

Well, i digress from the topic at hand… to continue …

So at the end of the day we cancelled the Offer to purchase (OTP) and cut our losses and moved on. The total costs associated with this failed transaction are as below:

Lessons:

- For any purchases, make sure there is a disclosure mandate from the seller

- Also make sure to ask the Agent for any issues that many delay or hamper the transaction

- Make sure that all accounts by the teller are up to date, this includes Levies, municipal rates and home loan account of the property as these could affect the transaction

- Lastly, do not be afraid to cut your losses and move on to the next. There is absolutely no need to delay the inevitable …

Going forward, in your property journey you are always going to come across different issues or scenarios that will test and slow you down. It is these very experiences that prepare you for the long run. That said, that is the rent we have to pay on this journey. All the best on your journey … i think this might just become my tag line from now on … all the best …